Budget Matter$

How are our schools funded?

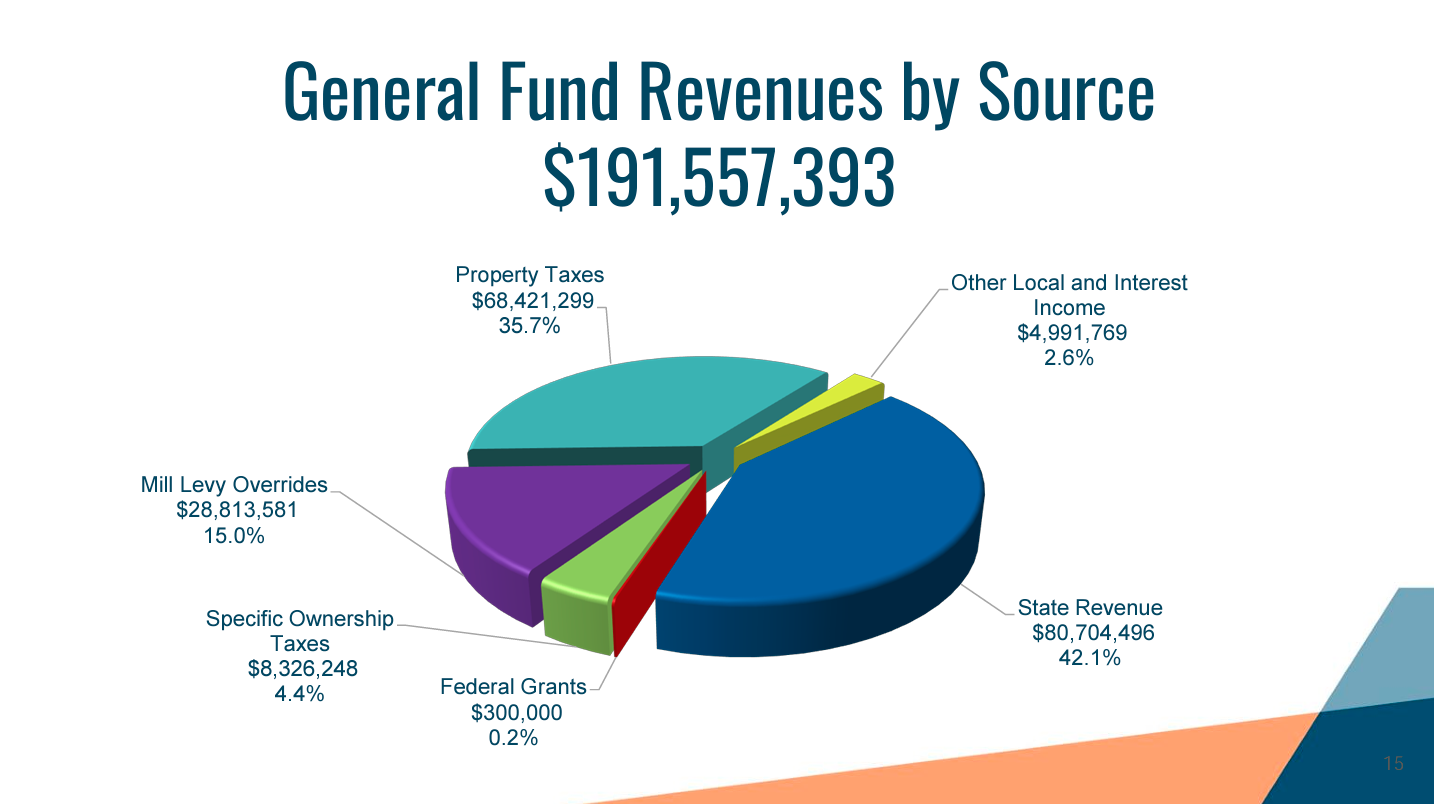

The district’s General Fund receives revenue from federal, state, and local sources. Total estimated revenue for 2024–2025 is $191.6 million. State revenue accounts for $80,704,496, or 42.1 percent. Property taxes account for $68,421,299, or 35.7 percent. Mill levy overrides account for $28,813,581, or 15.0 percent. Specific ownership taxes account for $8,326,248, or 4.4 percent. Other local and interest income accounts for 4,991,769, or 2.6 percent. And federal grants account for $300,000, or 0.2 percent.

How is the money used?

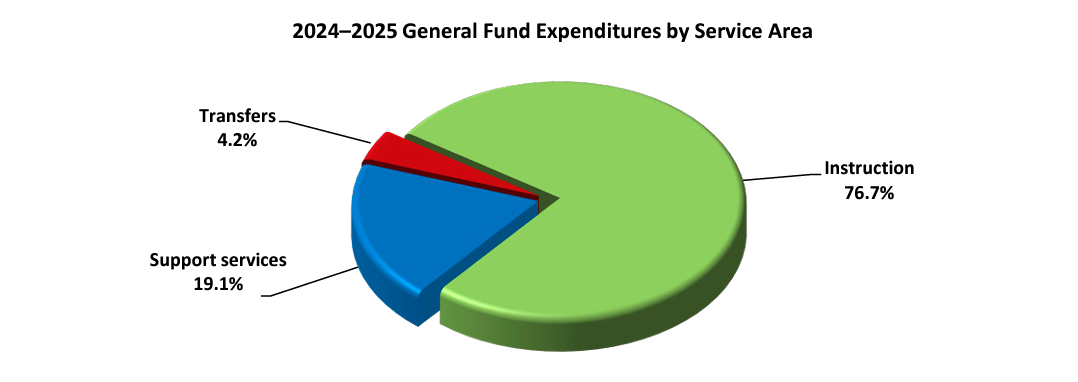

About 77 cents out of every General Fund dollar is devoted to instruction. Salaries and benefits, supplies, and other costs related to instruction of students, along with school building administration and special programs are included. Total support services account for $0.19 out of every dollar spent. Learning services, transportation services, and information and technology services are the largest expenditures in this component. Transfers to the Risk Management Fund; Capital Projects Fund; and Student Athletic, Activities, and Clubs Fund account for the remaining $0.04 out of every dollar spent.

Budget Update 2023-2024

Thanks to careful budgeting, our community’s passage of the Ops/Tech Debt Free Schools mill levy in 2020, and the Colorado Legislature’s decision to return a portion of the funds owed to public schools for the third year in a row, the LPS budget is in better shape right now than it has been in for many years.

This budget stability allowed LPS to address one of its highest Board priorities, which is to stay competitive with compensation, especially in the current environment of worker shortages. LPS was able to provide significant pay increases for all LPS employees. The timing was crucial as LPS works to stay competitive with surrounding school districts, local businesses, and neighboring governmental agencies.

LPS classified employees on average received a pay increase of approximately 10 percent, which went into effect January 1, 2023. This is the first time LPS has made a substantial, mid-year ongoing salary increase for classified employees. Beginning in the 2023–2024 school year, all LPS employees received a 4.5 percent pay increase over the previous year. In addition, the base pay for new teachers and special service providers increased to $51,275, up from $43,559 the previous year. The Board noted it was important to honor all employees with a much deserved pay increase, which also keeps LPS wages competitive and will help us attract and retain quality employees.

The LPS finance team wins national awards every year for its outstanding budgeting and accounting practices. This team prioritizes budgeting in order to provide the things our community values most: excellent teachers, quality programs, and a variety of support systems for all students. Learn more about the budgeting process on the financial transparency page of the district’s website.