Kaiser Permanente - DHMO Plan

- Deductible & Coinsurance may apply.

- Medical care is provided through Kaiser Permanente facilities and providers. No coverage outside the service area other than urgent or emergency care.

2023-24 Information

- 2023-24 Medical DHMO Summary of Benefits Coverage English

- 2023-24 Medical DHMO Summary of Benefits Coverage Spanish

2022-23 Information

Additional Kaiser Permanente Information

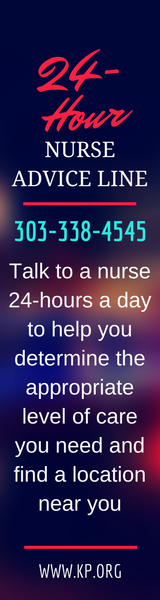

Finding Care

Search for Doctors or Facilities

Location Guide-Bilingual

Urgent Care vs Emergency Room Visits

Same Day Care Options

Same Day Care - SP

Getting Care Away from Home

Servicio a los Miembros

Out of Area Benefit

Healthy Lifestyle Programs

Call a Wellness Coach Today

Active&Fit Program

Getting Started

Como empezar con Kaiser Premanente

How to use Kaiser Permanente's My Health Manager

Como usar el Administrador de la Salud de Kaiser Permanente

Mail Order Pharmacy

Manage Your Care Online

Folleto para aplicacion movil

Personalized Online Cost Estimator Tool

Preventative Screening Guidelines

Preventative Services

Understanding Preventive Care Services

Kaiser Permanente - Kaiser HDHP with HSA

- 2022 HSA Contribution Limits: Single $3,650; Family $7,300

- Employees age 55 or older are allowed a catch-up contribution up to an additional $1,000 annually.

- The district contribution for employee only coverage is $1,250 per year or $104.17 per month. The district contribution for family coverage is $1,700 per year or $141.67 per month. When calculating how much to contribute to the HSA, be sure to deduct the district's contribution from the IRS limit.

2023-24 Information

- 2023-24 Medical HDHP Summary Benefit Coverage English

- 2023-24 Medical HDHP Summary Benefit Coverage Spanish

2022-23 Information

Get Registered

- Visit kp.org/register to view lab results, email your doctor, order prescription refills and more.

- Through kp.org, you can also chat with a doctor for answers to medical questions or to determine if you need to schedule an appointment.

For Current Kaiser Members Only

You're Invited to Earn Healthy Rewards

Tackle your health goals with a staff wellness program courtesy of Littleton Public Schools and Kaiser Permanente.

Members have the following options to get a no-cost flu shot and earn points towards a reward:

- Scheduled Appointments (beginning Sept. 1) - members can receive a flu shot at their next scheduled appointment at a KPCO Medical Office.

- Walk-in Flu Shots Sept. 1–Nov.30, no appointment necessary, 9 a.m.-5 p.m., Monday-Friday at the following medical offices: Arapahoe, Aurora Centrepoint, Franklin Lakewood, Lone Tree, Loveland, Premier, Pueblo North, Rock Creek, Westminster, Wheat Ridge

- Walk-in Flu Shots Oct. 1–Nov. 30, no appointment necessary, 9 a.m.-5 p.m., Monday-Friday at most medical offices (except behavioral health and Skyline).

- Saturday Walk-in Flu Shots throughout the month of October, from 9 a.m.-5 p.m., at the following medical offices: Aurora Centrepoint, Arapahoe, Fort Collins, Franklin, Highlands Ranch, Lakewood, Lone Tree, Loveland, Rock Creek, Premier, Pueblo North, Westminster, Wheatridge

- Flu Shot Flyer

Video Library

DHMO Plan

HDHP Plan

Integrated Care

Take Action

- Take a confidential online Total Health Assessment at kp.org/tha to see what’s impacting your overall health.

- Then, make good health a part of your daily habits with free healthy lifestyle programs at kp.org/healthylifestyle. You’ll find encouragement and tools to make healthier choices. Topics include: eating healthy, losing weight, moving more, sleeping better, reducing stress, and quitting smoking.

Enjoy the Rewards

Earn points towards quarterly drawings:

- Kp.org: 20 points

- Total Health Assessment (THA): 30 points

- Healthy Lifestyle Programs: 15 points per program up to 60 points

- Complete program activities between September 1, 2021-April 30, 2022 to be eligible for prize drawings.

Transparency In Coverage Health Plan Machine-Readable Files

Direct Link: Transparency In Coverage Health Plan Machine-Readable Files

This link leads to the machine-readable files that are made available in response to the federal Transparency in Coverage Rule and include negotiated service rates and out-of-network allowed amounts between health plans and health care providers. The machine-readable files are formatted to allow researchers, regulators and application developers to more easily access and analyze data.