Budget Matter$

Board approves 2021–2022 budget; District budget in better shape than it has been in recent years

During its regularly scheduled June 10, 2021 meeting, the LPS Board of Education approved, by a 5-0 vote, the budget for the upcoming 2021–2022 school year.

The budget is in better shape than it has been in recent years, due to a variety of factors:

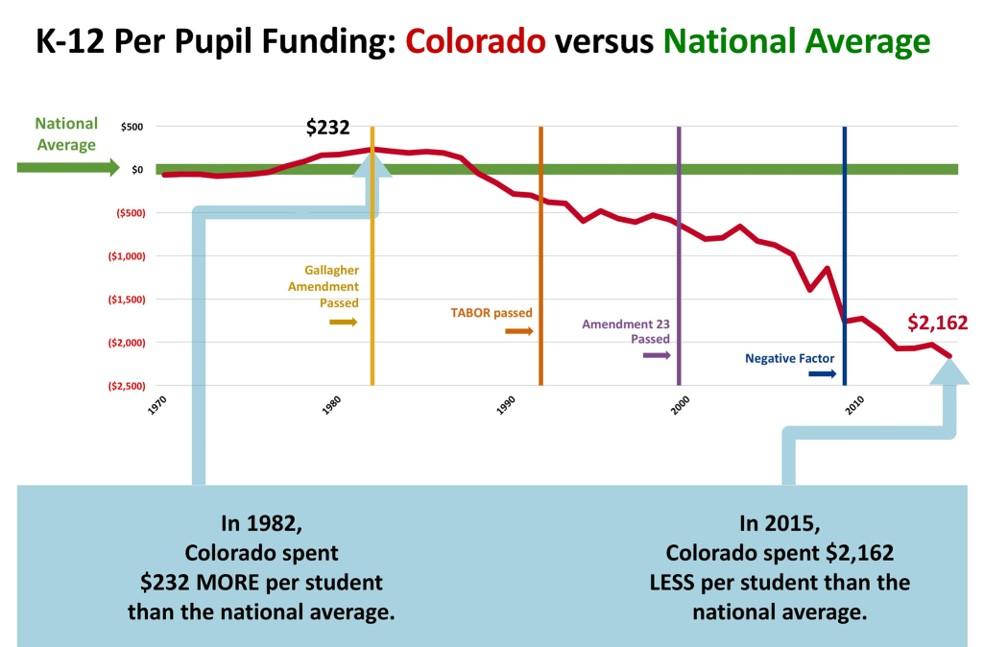

- The Colorado Legislature will hold back less money owed to Colorado K–12 schools than it has in over a decade. The Legislature reduced the Budget Stabilization Factor (or Negative Factor) for next year. The Legislature will withhold $9 million from LPS in 2021–2022, which is a big improvement over the $16.7 million withheld from LPS in 2020–2021. Since 2009, the Colorado Legislature has withheld a cumulative $156.8 million from LPS, shortchanging an entire generation of this community’s children of the education funding owed to them through Amendment 23.

- Local LPS voters generously approved ballot initiative 4C last November, which will raise roughly $12 million in the first year and each year thereafter to continue to attract and retain quality teachers, maintain counselors and mental health support, and expand programming such as career tech – the very things the LPS community says it values most in its schools.

- The district will utilize $3.9 million for COVID-related expenses from the federal Elementary and Secondary School Emergency Relief (ESSER) grant for the 2021–2022 school year.

- LPS was able to negotiate a zero cost increase with its insurance benefit carriers, which saves the district millions of dollars and keeps employee benefit costs the same as the previous year.

The 2020–2021 budget was challenging even before COVID due to the increase in the state’s Budget Stabilization Factor, which forced LPS to make $4.2 million in cuts for the 2020–2021 school year. Then COVID hit, and COVID-related expenses in LPS totaled more than $5 million.

“I want to thank LPS voters once again for their tremendous show of support last November by passing a mill levy override during a pandemic. Colorado continues to rank at or near the bottom in per pupil funding in the nation, and the toll that it takes has been evident the last few years,” said LPS superintendent Brian Ewert. “Our community helped ensure we can continue to build upon the kinds of quality programming our students deserve with the very best employees in Colorado.”

Thank you, LPS voters!

LPS voters approve ballot issue 4C in November 2020 election;

4C will raise $12 million locally to keep LPS on track as state funding crisis worsens

Thanks to the generous support of the Littleton Public Schools community, unofficial results indicate that Mill Levy Override 4C passed November 3, 2020 with 57.88% approval. Measure 4C allows LPS to raise $12 million locally to fill the $12 million state funding gap for the 2021–2022 school and in the years ahead.

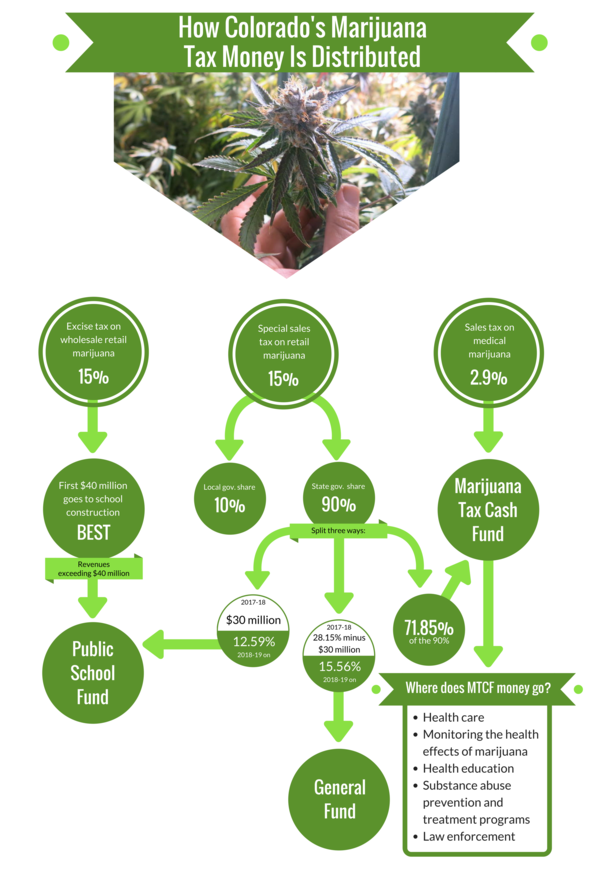

The Colorado Debt-Free Schools Act says that a school district can “impose an additional mill levy for the sole purpose of funding capital construction, new technology, existing technology upgrades and maintenance needs of the district without borrowing money.”

Passage of 4C will raise roughly $12 million in the first year and each year thereafter to contribute to expenditures that fall under those categories. This will, in turn, free up $12 million from LPS’s general fund that is currently spent on projects in those categories. The district can now use that $12 million of freed-up general fund dollars to continue to attract and retain quality teachers, maintain counselors and mental health support, and expand programming such as career tech – the very things the LPS community says it values most in its schools. The Board of Education may increase this amount by one mill per year not to exceed five additional mills.

The LPS Board of Education began exploring local solutions to the district’s worsening budget challenges last January. After making $4.2 million in cuts for the 2020–2021 school year, and with projected cuts of at least $12 million for 2021–2022 (and beyond) looming, the LPS Board recognized that these budget cuts would negatively impact the academic excellence this community values and expects of LPS if local solutions could not be found. The COVID-19 economic downturn in Colorado and the state’s chronic inability to adequately fund its public schools escalated LPS budget concerns. Over the past decade, the Colorado Legislature has shortchanged LPS of more than $156 million.

“We are extremely grateful for the support of the LPS community in passing 4C. Thanks to the voters, LPS will have a much better chance of weathering the COVID storm and the state’s economic crisis while continuing to provide our community’s children with an outstanding education, said Jack Reutzel, LPS Board of Education President. “This was a particularly difficult time to ask our community to support a local mill levy override, and we never take the decision to do so lightly. Our schools belong to the community; it was important that the community have an opportunity to decide what the future of LPS should look like.”

“Passage of 4C was arguably the most important factor in the success of LPS moving forward,” said LPS Superintendent Brian Ewert. “Without it, LPS would have had to make devastating cuts to people and programs. It would have changed the face of the district. Now, LPS has a fighting chance of keeping the level of excellence our community expects and deserves for its children, and we are grateful. On behalf of the entire district and the Board of Education, I want to thank not only the generous voters but also all of the volunteers in the Citizens for LPS campaign who worked tirelessly to pass 4C. It truly makes all the difference.”

If the Colorado Legislature chooses to make even further cuts to K–12 education during the upcoming legislative session beyond what is projected, LPS may still have to make strategic budget reductions.

What’s next?

November 12, 2020: The Board of Education is scheduled to certify the preliminary election results.

December 10, 2020: The Board will receive an update from the LPS Financial Advisory Committee and will certify the 2021 mill levy.

January–May 2021: The Board will continue its conversations and planning before the 2021–2022 budget must be finalized in June 2021.

The LPS Financial Advisory Committee will review the use of the new dollars to ensure that the funding is used wisely for the purposes that were represented to the voters.

Pandemic: State Funding for Schools Goes from Bad to Worse

Board considers funding options to keep what's most important to our community

Even before the pandemic, the State of Colorado had shortchanged LPS of more than $156 million over the past decade, which has put tremendous and increasing pressure on the district’s budget. In January 2020--after making $4.2 million in cuts for the 2020–2021 school year and projecting upwards of $9 million in cuts beyond that due to a lack of state funding--the LPS Board of Education was concerned enough about the LPS budget moving forward that it conducted a community survey to see what taxpayers hold as the highest priority in LPS and if they would support a local mill levy election to help lessen the effects of Colorado’s failing economy to LPS. Then COVID-19 happened, and the projected losses to LPS grew. Since March 2020, COVID-19 continues to further cripple Colorado’s economy, and funding for Colorado’s public schools continues to fall further and further behind.

Throughout the summer, the LPS Board of Education studied various options available to fill the anticipated ongoing $12 million budget gap LPS will face caused by the COVID-19 economic downturn in Colorado. No state solutions are in sight. The State of Colorado is unable to fund its public schools to the point that people and programs--the very things the LPS community values most in its schools--will be cut in for the 2021–2022 school year if solutions are not found.

Another community survey was conducted in late July to see if community sentiment has changed since early February. Survey responses indicate support for a local mill levy election to keep the very things our schools value the most:

- Quality teachers

- Variety of quality programs for students of all ages

- Physical safety

- Mental health supports

- Expanding career, technology and skilled trades classes that provide students with real world job skills.

In July, two-thirds of responses prefer the LPS community invest in the school district given the reductions in state funding, rather than experience even further cuts to people and programs that affect students.

The Board of Education will continue its conversation about the budget and the possibility of a local mill levy ballot initiative during its regularly scheduled August 13, 2020 meeting.

View Superintendent Brian Ewert's presentation to the Board of Education July 30, 2020

LPS Budget Suffering Greatly Due to COVID-19; No Solutions at the State Level

As we plan for our return to school in the fall, and just when we need additional funding the most, all Colorado school districts including LPS are facing some of the biggest budget cuts we’ve ever had. The negative effects of COVID-19 on Colorado’s economy are causing a $3.3 billion shortfall in the state budget for next year, and public education will take a huge hit.

Littleton Public Schools will lose $9.5 million in state funding for the upcoming 2020–2021 school year. LPS will receive about $6 million in federal COVID-19 relief funds (CARES Act) that will help offset some of the budget shortfall next year. But, COVID-19 relief funds are only available for a short time and will not help us after next year. Therefore, deep cuts will continue for the next few years until Colorado’s economy recovers. These cuts are in addition to the $4.2 million in cuts for next year that were decided back in December, 2019, which resulted in the loss of 17 positions at the central office and a variety of other reductions throughout the district.

“There is no clear savior for Colorado schools at this time,” said Diane Doney, LPS Assistant Superintendent of Business Services/Chief Financial Officer. The LPS Board is discussing the different kinds of local ballot measures it could ask the community to support this November. It’s important to remember that the State of Colorado has owed its public schools funding since 2002. Last year the amount owed was $572 million; next year, due to COVID-19, the amount owed will double to $1.1 billion.

The Board will continue its conversations throughout the summer regarding how to face the budget crisis locally both now and in the years to come.

State of Colorado's Debt to LPS Grows at Alarming Rate

Colorado's School Funding Restrictions Mean Millions in Cuts to LPS Again

Budget cuts are here again in Littleton Public Schools.

As has happened every year for the past decade, the Colorado Legislature is withholding millions of dollars from LPS and all Colorado school districts through what it calls the Budget Stabilization Factor, also known as the Negative Factor. The financial loss in LPS alone for the 2019–2020 school year is $9 million. Between 2010 and June 2020, the Negative Factor will have shortchanged LPS of nearly $140 million.

As a result, $4.2 million of general fund budget cuts must be made in LPS for the 2020–2021 school year.

- LPS is absorbing rapidly increasing costs in PERA, health care, transportation and special education.

- LPS has a priority to attract and retain the best employees. Maintaining competitive pay and sustaining it in the future will require new money.

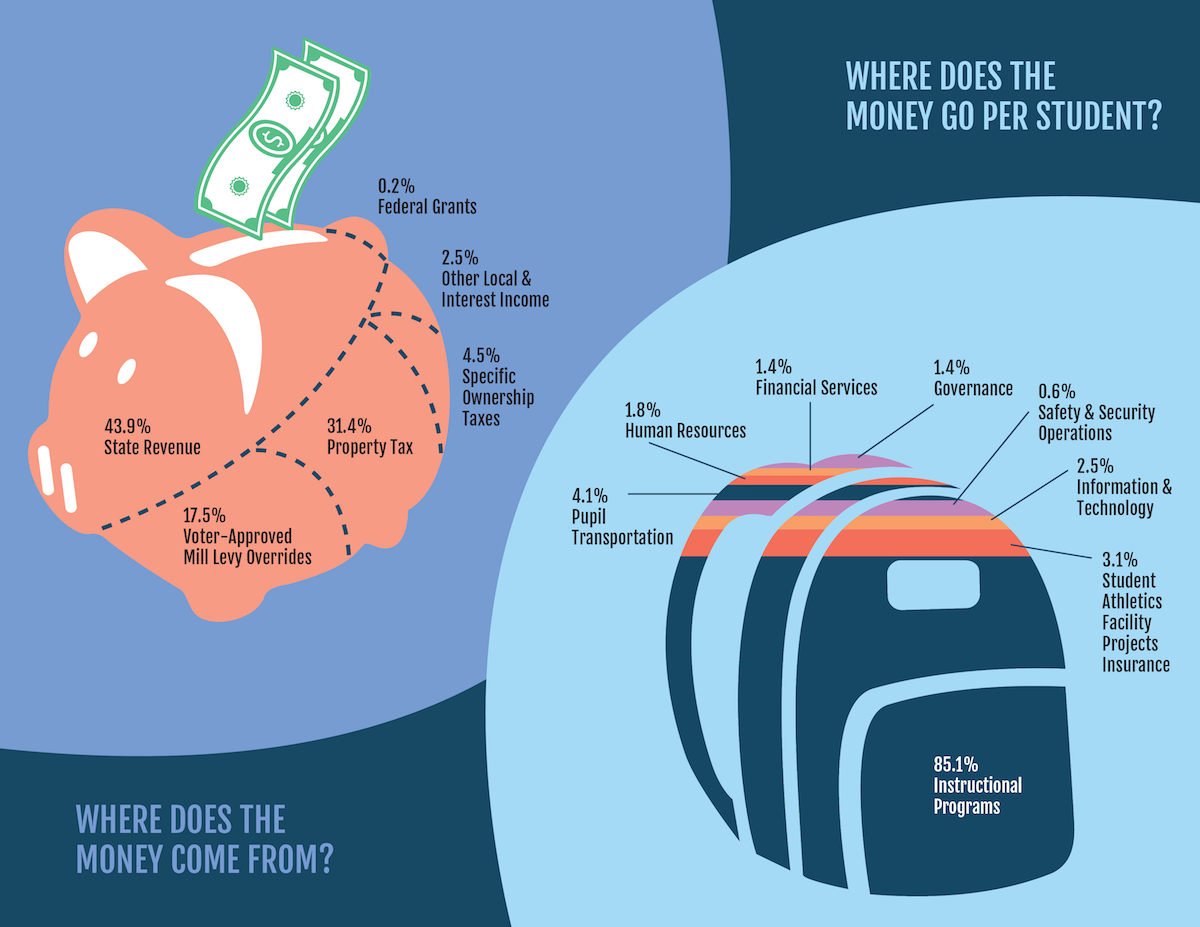

- LPS enrollment continues to be flat due to our community’s limited capacity for growth. Flat enrollment means no additional state funding for growth.

In October 2019, Board members discussed how rapidly increasing costs in special education (which have never been funded appropriately by the federal government for decades), transportation, salaries and benefits mean cuts are necessary. LPS is looking for savings everywhere possible at the district level. However, because 85% of LPS’ general fund budget goes toward people (salaries and benefits), it’s impossible to cut millions from the general fund budget without cutting positions. The goal is to keep these cuts away from the classroom as much as possible and to protect services in safety, security and mental health.

During budget workshops in October and December of 2019, Board members discussed various options for cutting $4.2 million next year. In December 2019, the Board directed that the following cuts be made for 2020–2021:

- Reduce central office positions through retirements, the elimination of some positions, and not filling some vacancies at this time;

- Reduce staffing allocation to secondary schools by 0.5 FTE (full-time equivalent), and reducing staffing allocation to elementary schools by 0.25 (FTE);

- Reduce pay for all administrators and year-round classified staff;

- Reduce pay for all certified staff (teachers) through one furlough day (subject to negotiations with the Littleton Education Association);

- Reduce the amount of funds used for capital projects and risk management;

- Increase the fees self-sustaining programs such as School Age Child Care, Driver’s Education, and Nutrition Services pay to the general fund;

- Reduce the subsidy the district gives to high school athletic and activity funds, which will result in increased fees;

- Increase fees for preschool;

- Eliminate selected software subscriptions.

Approximately two-thirds of the cuts in positions and salary reductions are coming from the central office. Seventeen central office positions are being cut. Those due to retirements include the assistant superintendent of business services/chief financial officer, director of learning services, coordinator of gifted and talented services, special education instructional coach, executive administrative assistant, and coordinator of career and technical education. Additional reductions in central office staffing include chief information officer, tech support specialist, math teacher on special assignment, two administrative assistants, data submission specialist, wellness coordinator, terminal manager, and carpenter. Vacancies that will not be filled include human resources specialist and literacy specialist.

“The work these professionals have accomplished has been vital to the school district, and the loss of these positions is a blow to the system,” said Ewert. “These are not decisions we would make unless we had to. It was the only way to protect schools from cuts as much as possible. We will be giving careful thought in the coming months to how to reorganize the work and the system. We should have a plan in May.”

Two Other Issues Impact Staffing for the 2020–2021 School Year

1. LPS can no longer use 2010 mill levy funds to continue to fund staff positions as it has for the past three years.

The loss of federal grant money three years ago caused a crisis because it happened at the same time the Board made a commitment to infuse substantial, ongoing general fund dollars into safety, security, and mental health. The only way to keep the positions previously funded with federal grant money was to use one-time 2010 mill levy funds (which had been stretched to last a decade), knowing that funding would no longer be available at the end of the 2019–2020 school year. Simply put, until now, LPS has been able to absorb increasing costs to the general fund with 2010 mill levy override funds, but it cannot do so any longer.

2. Staffing at the schools fluctuates every year because it is driven by projected enrollment.

Each school is staffed largely according to the number of students projected to be enrolled in that school. As is the case every year, staffing numbers can increase or decrease at individual schools if their projected enrollment for next year is larger or smaller compared to the current year’s enrollment. Some schools will receive more funding for staffing next year, and some will receive less. Overall, LPS is projected to fund 14 fewer full-time positions in schools next year due to declining projected enrollment.

$1 million of unrestricted funds will help bridge further staffing cuts for one more year while other solutions are explored.

In January, 2020, The Board chose to provide $1 million of its unrestricted fund balance to lessen the impact of school staffing changes driven by the lack of 2010 mill levy funds and projected enrollment will have next year. About $400,000 will be dedicated to “pool points,” or staffing dollars to help wherever there is the greatest need in schools across the district for one year. The remaining $600,000 will fund secondary instructional coaches and elementary deans, both of which are school-based positions, for one more year. The Board noted using one-time money to fund staff positions was not an option it would have considered in better financial times.

What's Next?

The district will adjust to these staffing cuts, and possible solutions for future years will be discussed throughout the spring. There are no easy solutions, as TABOR continues to restrict the amount of state tax dollars collected for education, roads, and social services. That means that school funding will fall further and further behind, and the $156 million the state owes LPS will likely never be paid. The only way public schools in Colorado can meet the needs of students is through the passage of local elections. Thanks to the generosity and collaboration of LPS voters, such mill levy override elections in the past have helped LPS continue to keep the level of excellence its community expects and its children deserves.

“Thank you to our administration for bringing this need to the Board when it did,” said Board President Jack Reutzel. “This is a bridge for one more year. I have far more faith in our community to figure this out than I do the Colorado Legislature.”

Colorado's Entangled Constitution Hurts LPS

Passed more than two decades ago, the current school finance act – formally the Public School Finance Act of 1994 – no longer serves the needs of Colorado students. In 2000, Amendment 23 – a citizen’s ballot initiative – was passed, mandating that “base” per-pupil funding increase each year by the rate of inflation. But in 2009, the state legislature reinterpreted Amendment 23, creating the Negative Factor, which immediately began stripping school districts of critical funding and shortchanging an entire generation of LPS students of the education they deserve. (Read more about the Negative Factor) While Littleton Public Schools is fortunate to have overwhelming community support – passing every bond and mill-levy override ever brought to an election – it has still not been enough to combat the sizable deficit caused by the Negative Factor.

Imagine what LPS would have been able to do to meet the needs of students with the $156 million in state funding it never received.

History of LPS Budget Cuts and Locally Passed Elections Due to Lack of State Funding

1988 – $3 million mill levy passed to supplement the general fund

1992–1993 – $1.7 million in cuts

1993–1994 – $2.6 million in cuts

1994–1995 – $1.3 million in cuts

1995 – $44.3 million bond election passed for capital improvements only (cannot supplement the general fund)

1995–1996 – $3 million in cuts

1997 – $5 million mill levy passed to supplement the general fund

2001–2002 – $3 million in cuts

2002 – $85.4 million bond election passed for capital improvements only (cannot supplement the general fund)

2004–2005 – $3.5 million in cuts

2004 – $6.5 million mill levy passed to supplement the general fund

2008–2009 – $1.5 million in cuts; $1.5 million from reserves; $532,000 mid-year rescission

2009–2010 – $4 million in cuts

2010–2011 – $7.5 million in cuts

2010 – $12 million mill levy passed to supplement the general fund

2011–2012 – largest cuts to K–12 funding in Colorado history; mill levy funds used to backfill more than $5 million in cuts from the state

2013 – $80 million bond election passed for capital improvements only (cannot supplement the general fund)

2018 – $298 million bond election passed for capital impvovements and new construction (cannot supplement the general fund)

2020–2021 – $4.2 million in cuts

2020 - $12 million mill levy passed to supplement the general fund